Womble Bond Dickinson associate discusses monthly budget

A young lawyer has taken to TikTok to discuss her monthly budget and how she spends her hard-earned cash.

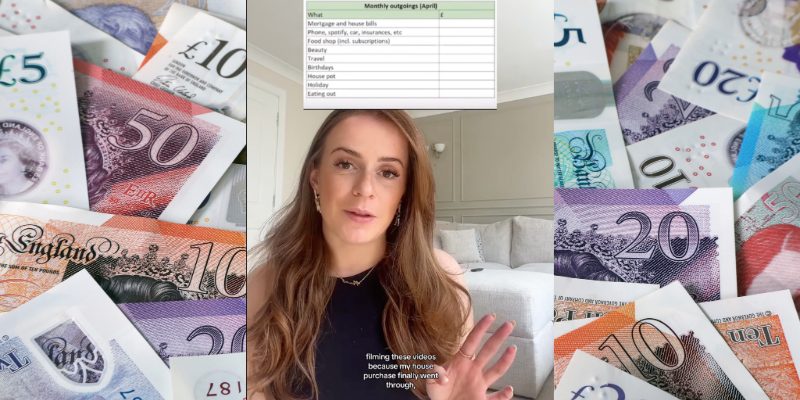

Mia Siddique, a junior associate at Womble Bond Dickinson, qualified into the firm’s Southampton office in September 2023. While not revealing the numbers on her paycheque — and careful to distance herself from top junior salaries in the capital: “I don’t work out of London so no, I’m not on hundreds of thousands of pounds” — Siddique has provided a breakdown of her monthly outgoings, increasing transparency around legal salaries.

@legallypossible Having struggled my entire life through balancing multiple jobs whilst studying, growing up in a council house and living paycheck to paycheck, it’s a huge privilege to be able to do these videos and finally be in a position of financial stability. I don’t take it for granted and I share these videos for others who are interested, who want to learn how to budget better or who want to see that it’s possible to earn a comfortable salary no matter your background. 🚀 This is after all deductions eg pension, taxes, employee benefits etc! #lawyer #solicitor #socialmobility #anythingispossible #budget #budgeting #lawyersalary #budgetwithme #payday #finance #savings ♬ original sound – mia | lawyer 🪩

Having purchased her first home recently, Siddique sets aside £1,400 each month for mortgage repayment and household bills, while £250 goes on personal bills, including her phone bill and car insurance, and she normally allots around £220 a month for food shopping.

The junior lawyer revealed that she spends £130 each month on beauty products and treatments, telling her followers: “Getting your nails done, getting your lashes done and buying nice skincare is such a privilege. I am very grateful and do acknowledge that.”

She aims to spend £150 a month on travel, living a 3 hour commute from the office, where she works “once or twice a week”. £350 goes on birthday presents for friends and family and £200 towards furniture and home decor.

This month she is spending £100 paying off a previous holiday and while she had planned spend no more than £200 eating out, she has already overspent on this: “I always find myself, as soon as I get paid, going absolutely crazy!”

Any money she doesn’t spend this month, will go into her savings.

In the video’s caption, Siddique reflects on her financial backstory:

“Having struggled my entire life through balancing multiple jobs whilst studying, growing up in a council house and living paycheque to paycheque, it’s a huge privilege to be able to do these videos and finally be in a position of financial stability.”

Viewers in the comments compared Siddique’s monthly spend to their own financial situations. One user commented: “Girl, I pay £1,550 for rent in London and bills are added on”; another added “£2,700 a month on our mortgage alone in Essex… silly prices here!”. Others praised her openness about money, “Love the transparency!!!”.

An envious fellow lawyer joked, “This is a great salary. My lawyer salary in north of England doesn’t cut it 😂😂😂 💞💞💞” while others left messages of support: “I am so happy that you got that finanical freedom, you worked so hard for it 🥰 I remember watching you right from the start! Keep shining Mia! 🥰”